It's Halloween, everyone's entitled to one good scare.Congratulations to the bears for finally giving the bulls a bit of a scare just before Halloween no doubt. Lots of interesting things to observe today so lets start with our SPX 15min PnF chart once again to highlight our 1757.8 and 1764.6 support and resistance areas that we spoke about in our previous post. To continue with our trade example we would have been stopped out today since price broke below the 1764.8 support which served as the stop loss trigger. You will also notice that price hit support 1757.24 (shorting after the FOMC meeting) before rallying right back into 1764.6 area of resistance. As you can see the 1757.24 area is becoming more and more significant.

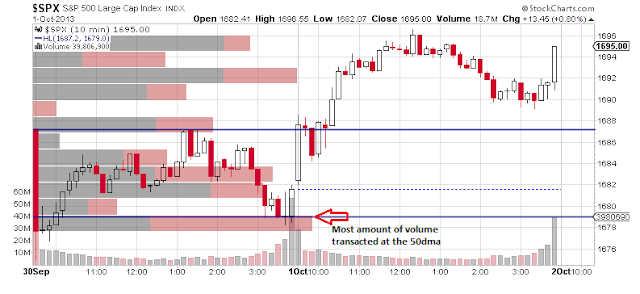

The SPX 5 min candlestick chart shows the price action today around those areas of support and resistance. You will also notice that as price hit an all time high earlier on in the day it appeared as distribution with the high volume associated with those price levels. This is looking more and more bearish as supply appears to be entering the market as last.

Switching to the SPX daily candlestick chart there are a number of bearish factors about today's session. First we had the largest price range in two weeks with price hitting an all time high only to close near the low of the range. Second, volume increased slightly today (more so on the SPY) which indicates that supply is coming into the market. However, we still have our 1757 area of support which is growing in importance so as long as price remains about that level the bulls are safe for another day. However, if we do break support then you can with a certain level of confidence consider a short position and look for the next level of support. Enjoy your Halloween!

Thanks for reading.