Repetition of the same thought or physical action develops into a habit which, repeated frequently enough, becomes an automatic reflex.Norman Vincent Peale

I know this blog, now only a month old, sounds like a broken record. Supply and demand, support and resistance, volume, <insert offensive comments>, blah blah blah. However, the quote above is exactly what I'm shooting for. Just like a good athlete that practices the same moves and set ups over and over again until it is second nature to them when the opportunity presents itself they don't have to think about it they simply react. This is analogous to a good trader. The best part is you don't have to be perfect you just have to be good. Good traders just like good athletes can perform under pressure. More importantly they believe in their abilities and react automatically to the setups they have studied and seen a thousand times before. Imagine if Michael Jordan paused and wondered if he should shoot or dunk each time he was passed the ball with only seconds left on the clock.

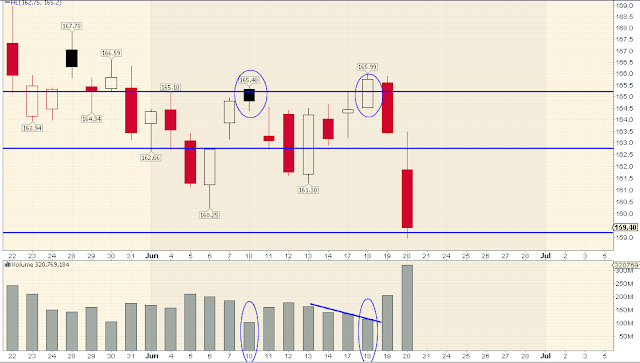

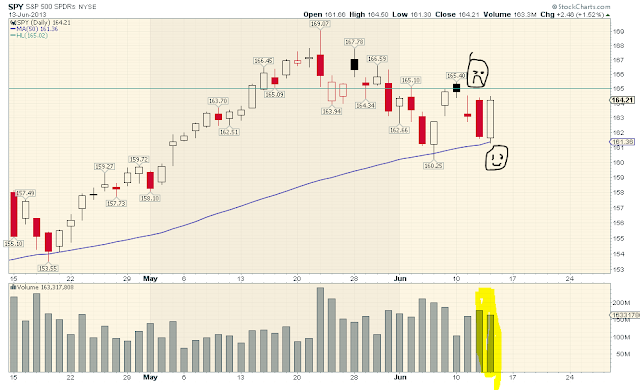

The three day rally that ensued was no surprise and where it hit resistance is even less of a surprise. I had been expecting some type of rally based on the large volume seen on the recent down move. I saw that as a transfer of ownership from the weak to the strong handed market players. We saw the importance of the 1594 area acting as both support and resistance this week and watched as it broke and tested this area before rallying to a high of 1620 this week. But why did it stop there you ask? If you look at the daily chart of the SPX below you will see that on Thursday both the 50 day and 20 day simple moving average converged right at 1620. I spoken extensively about the importance of the 50 day moving average (dma) on this blog as well as the 20dma. You can read these bits of brilliance here.

To have both moving averages converge at the same point would have been a great opportunity to assess the potential of either reducing longs or adding shorts. Also note that we had a bearish cross over of these moving average not seen since November 5th 2012. Just saying. However, remember the larger plan here or at least one of the many set ups I believe may transpire. We have had a relatively large volume downmove with a resulting low volume up move. I view the large volume as bullish especially considering it happened in and around major support levels. However, before I can believe the market will continue to move higher I would like to see a test of the high volume area between 1576 and 1594 on lower volume and of course with these support levels holding. Why? Because the low volume test would signal to me that there is a lack of supply and that the previous high volume area was indeed a transfer of stock from weak to strong hands. So lets see what happens next week as it should provide us some good opportunity. The market is ready to pass you the ball are you going to be Michael Jordan or Sun Yue? Who is Sun Yue? Exactly.

Thanks for reading.