“Disregard for the past will never do us any good. Without it we cannot know truly who we are.”

― Syd Moore

In trading, analyzing what happened in past and what is transpiring in the present is a requirement to anticipating the future. You can quote me on that! So lets first look at the past. Below is the 30min PnF chart of the SPX from the close of August 30th. You can see from the highlighted region that this trading range resulted in a quick drop from 1700 area to the 1630 in just a few weeks. That trading range was an area of distribution. What is distribution. Distribution, as I see it, is the transfer of ownership from the strong to weak handed. How did we know this area was distribution? Because price moved lower after breaking the trading range! Duh!

Markets have a memory because the market is made up of many many greedy and fearful and intelligent and semi-intelligent individuals called traders and/or investors that have a memory. Some memories are pleasant some or nightmares. Those individuals that went long within this trading range (or even worse higher) have a not so pleasant memory of what transpired after.

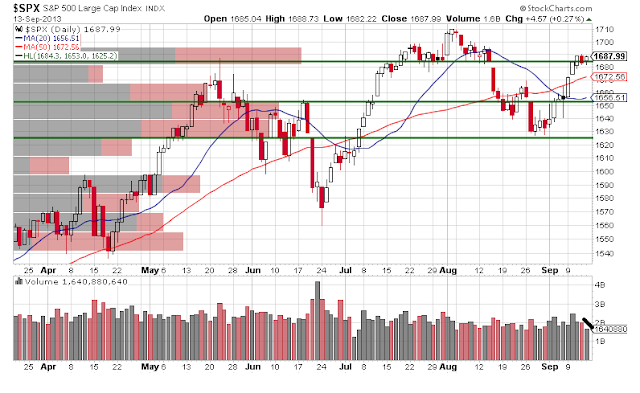

If we continue with our history lesson you will notice the amount of volume transacted within the area of 1684 and 1692 range was relatively large as indicated by the volume by price bars on the SPX candlestick chart below. Since resistance is defined as any area where supply exceeds demand the larger the volume at that area of resistance the more overhead supply. The point is that we know ahead of time where the area of resistance is and the amount of overhead supply. Great information to have if price were to approach this area again. But that was history lets fast forward to the present.

Well price did make its way back to this area of resistance. What is so fascinating (and truly is fascinating) is how the market was 'speaking' to us as it traded at this resistance level. You can see from the red circle on the SPX 60 min chart below that price consolidated in this heavy area of overhead supply between 1684 and 1692 for a couple of days BUT price didn't fall. There was a lack of supply that entered the market in an area of heavy supply. There was a reluctance to sell at these levels. Possibly because losing positions are now breaking even and the expectation is for further higher prices. However, if the large institutional and professional traders want to see higher prices they are certainly not going to try to buy their way through all that supply should it begin to flood the market. They also know that the longer price remains at these levels without any upward progress the more inclined those holding at break-even are to sell. Don't want to be twice bitten! So when you see a large train of supply potentially coming your way what do you do? Jump over it like an Olympic higher jumper. That is exactly what happened. You will notice that Monday's opening gap began at 1691.70 (lets round to 1692), the top range of the overhead supply, and prices never looked back. Brilliant! The bag holders in the area of 1684-92 are finally seeing a profit and are patting themselves on the back for holding instead of selling with their sights now set on new highs. The large institutional and professional traders where able to leap frog over the overhead supply with minimal cost and increase their profits. Of course this is just my interpretation of what I think is happening but if I'm even partially right then remembering what transpired at this area of resistance will help us the next time price revisits this area.

Here is some food for thought, what if you were one of the many bag holders that bought in the 1684-92 area that just saw their investment recover from a nasty loss now turning a profit? How do you feel? What if that market continues higher to challenge or even break to new highs roping others to initiate new long positions or add to their existing positions in the process? How hopefully are you now? Then the unthinkable happens, prices come back to your break-even price. What do you do? Think about it.

Thanks for reading.